1

Told you I would be back next week. “Actually you told us that in our voice because we knew it already, nerd.” Okay, fine; Twitter knows better than to lock out its biggest addicts for too long. Looks like I will have full access again on Saturday.

2

I try not to give investment & trading advice because any rules you internalize, besides the most general safeguards, harden into inflexible behaviors that can send you into a spiral of terrible performance. Our greatest advantage as small investors is our adaptability, the element of play and experimentation that funds and institutional investors avoid.

However, since I was asked, I will share one strategy I have used to considerable returns lately. It comes from Nicolas Darvas’ book How I Made $2,000,000 in the Stock Market. One of his central tactics was to select stocks as a ‘value investor’ would, limiting his options to those securities he believed would appreciate in value over a twenty-year horizon. But he would trade these stocks as a ‘technical analyst’ would, locking in short term gains to reinvest. I believe our current environment— especially if we are entering a protracted sideways period like the 1970s, where the hodl-to-retirement mindset will leave you behind— has re-created the opportunity for this style of reasoned agility.

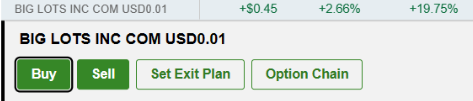

Here are three such examples I closed from last week at 20 to 60 percent gains. All were selected from a smaller universe of stocks I track based on balance sheets, some combination of price-to-sales or free cash flow that suggests the companies are discounted beyond what I consider their ability to weather the recession. When I entered the positions, all were approaching (as shown on the charts) their ‘covid crash’ lows which, like the market as a whole, I consider an indication of panic-level fear of insolvency. It is quite possible some of these stocks, based on their fundamentals, appreciate five to ten times in value over the next decade or sooner. (It is also possibly continue sliding). However, waiting for this appreciation to realize would yield an outcome identical to simply maintaining my 30 percent annual compounding gains. I would rather be nimble and lock in gains to reallocate now than wait for a hypothetical payday that may not obtain in a prolonged period of sideways action. We also should not discount market psychology. Institutional investors and algos are liable to recognize when securities are discounted to the doomsday scenario level. So long as I can sometimes remain a step or two ahead of their shortsightedness, I can profit on their scramble into these stocks (some of which is short-covering).

Okay, but none of this is the real lesson. Here is the real lesson: Darvas— whose strategy succeeded for him, and for me once I perceived we had entered an environment where it seemed reasonable— was a professional dancer. He turned to investment out of personal interest and, when he wasn’t dancing, read over 200 books on investment and the stock market. You have this advantage over the funds and professionals too. I’ll let you in on a not-so-secret secret, the professionals do not read, and what they happen to read by accident is largely irrelevant to an individual investor because what works for institutions does not work for individuals. We see this in many ‘professional’ fields. Why is it that whenever you read a meaningful psychology blog the author is influenced by psychoanalysis, which the ‘professional’ psychologists assure you has been debunked? It is because psychoanalysis, for its many genuine flaws, was oriented toward individuals. Since academia has become bureaucratized, it has been reoriented toward institutions; psychologists can perform tidy studies that inform governments and megacorps how to ‘nudge’ people into calm compliance, but what of value have they given to help you govern your interpersonal relationships? Now generalize that to every field whose practice requires a graduate degree.

And that’s another reason I find it difficult to give investment advice. What is my strategy? I read a lot till my mind is filled with enough vicarious experience, in addition to my own, to flexibly adapt to the continually changing financial landscape as I see it. Sometimes I can map this process to a concrete strategy, as I have suggested here, but other times the process is left subconscious and would take more work than it’s worth to formalize (which may at times be counterproductive). And, let’s face it; you will never become good at an intellectual pursuit and your ability to apply it competently to the real world if you cannot commit to reading 200+ quality books in the field. Good things come to those who suck it up and stop being a little retarded bitch.

3

@SouthernWintrs shared with me the news that the FAA grounded all flights last week due to a computer glitch. It comes a week after I noted events like those that unfolded in Jackson, which mysteriously lost its water treatment capabilities last year, would become increasingly common this century. Critical infrastructure will be unevenly distributed as the country we call ‘America’ fragments into its natural social and political entities, a cyclical process that unfolds over centuries but whose nadir is still shrouded in fog. Bridges and roads will crumble, water will become undrinkable, power will become inconsistent. You can identify some issues, parallel to those found in Jackson, on the FAA’s about page. Now, the ‘demographic features’ are most obvious, but I wouldn’t ignore the educational ones: you have degrees in ‘aviation management’— x business degrees are unambiguously retard-coded, which is fine if you’re working at a car dealership yet less so as an administrator for a large government agency— and ‘political science.’ What happened is every black engineer and physicist went to work for Google et al. Looks like USG’s diversity-maximization regulatory regime backfired, and they’re still required to save face and overstaff senior positions with nth tier backup options. We may and should strive for near-term, local victories and reversals, but there is no way to turn back the ratchet of world history. We can, however, recognize the trends and prepare accordingly.

4

From what I’ve heard of Boston it seems this meme is relevant again. What is this, the fourth time since 2020? Sci-fi won’t suffer the same unfortunate genre fate as the Western, even if we can no longer get ahead of the future. (And distilled to a single word the essence of sci-fi is ‘counterfactual’. Hmm)

5

Speaking of genre-ending works, I couldn’t sleep last night and watched Mike Nichol’s Closer. An insufferable genre is the American ‘extramarital affair drama’ that became common mid-to-late century. Fatal Attraction, Indecent Proposal, Bridges of Madison County, American Beauty— all thinly-veiled fantasy enactments, especially when one of the characters dies. Even in the ostensible horror movies, like Fatal Attraction, the ‘horror’ is primitive wish fulfillment: “oops, my lover turned out to be a psycho and has to die, giving me the necessary purgation to return to normal after the fact.” How about that. Closer is closer to an actual extramarital affair horror story. (There are two reasons you might disagree: you think it’s a stupid movie and a waste of time or you need to find religion. Now you know— don’t hide from yourself). All it comes down to is characters starting into the void, a play on nihilism. American cinema can no longer improve on this niche subgenre, which now is relegated to the status of ‘plot device’ (as in Gone Girl); it marks the end of an era of boomer decadence. Not coincidentally, it had to be directed by Nichols, who started the genre with The Graduate (although the movie itself, in a sly bit of postmodern reflection, suggests the true first culprit was An Affair to Remember). Perhaps he needed to expiate a little bit of guilt himself. Still it was sad to see, true to boomer form, that Nichols decided the right direction to move was the vaguely leftist political drama. Oh well

Closer is an excellent film, peak Clive Owen. I give a lot more credit to Marber than to Nichols, it's all about the script really.